Quick Navigation

We understand how exciting buying an RV can be, but taking the right steps before applying for an RV loan can make a significant difference in not only your experience, but also securing the best financing available.

To help you get started on the right path, we have outlined ten essentials before submitting your loan application so you can save time, money, and stress in the future.

1. Know Your Credit Score

Naturally your credit score plays a crucial role in the loan process. This number can affect multiple areas such as your creditworthiness, your interest rate, and your loan terms. Having a higher score can lead to lower interest rates and better overall loan offers, while a lower score may require a larger down payment or a co-signer.

We recommend before applying, that you use free credit monitoring tools such as Experian, Equifax, or TransUnion. This will help you have informed answers your loan officer may have later on. Review your report carefully to identify and address any errors that could hurt your application.

Even if you have bad credit, at My Financing USA, we specialize in finding solutions like bad credit RV loans to help more families have their dream adventures.

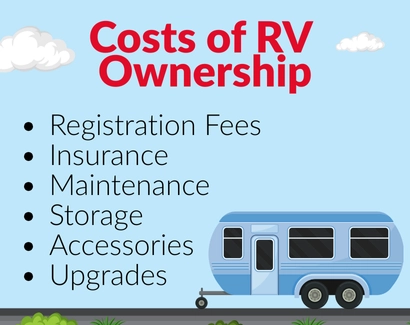

2. Understand the Total Cost of RV Ownership

While most buyers focus on the initial sticker price of the RV, this is just the beginning. Before you apply, it’s important to take time to understand the full cost of ownership. This could include insurance premiums, maintenance and repairs, storage facility costs, and even campground fees. Understanding the full financial picture can help you determine a realistic budget ensuring your new dream purchase doesn’t become a financial nightmare.

3. Decide What You Want to Buy before Applying

While some buyers like to apply while shopping for their new RV, having a clear idea of the make, model, and year of the RV you want can be key to a smoother loan process. Whether you are looking for a new unit or a pre-owned model, or buying from a dealer or a private seller- all these variables can influence financing options. Some lenders have restrictions based on the age or type of unit. For example, RVs older than 15 years may only qualify for financing on a case-by-case basis.

If you are specific about the unit you want, this will help lenders provide you with more accurate loan terms upfront.

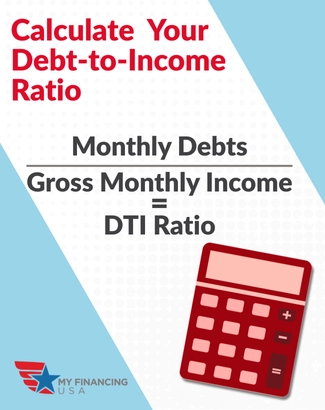

4. Know Your Debt-to-Income (DTI) Ratio

Your Debt-to-Income ratio (DTI) is another major factor lenders consider when reviewing your loan application. Not sure how that works? Here is a simple way to calculate that!

(Total Monthly Debt Payments) ÷ (Gross Monthly Income) = DTI Ratio

A lower DTI ratio increases your chances of approval, because it signifies you could comfortably afford your new purchase. Knowing your DTI ahead of time will also help you have realistic expectations before hitting the submit button.

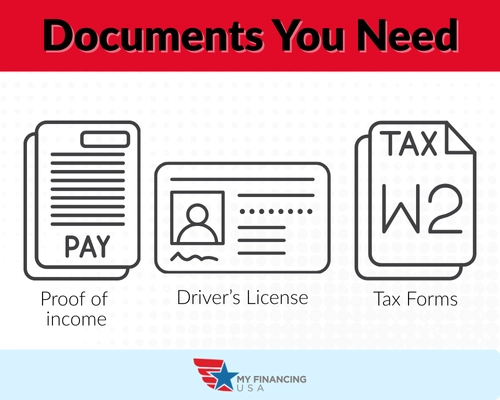

5. Organize Your Documents

Like any loan, we are going to need to verify critical information. Having your required documents ready can make the loan application go much more smoothly. Before you apply, please gather the following:

- Proof of income (recent pay stubs, W-2 forms, or tax returns)

- A valid driver’s license. (Make sure it’s not expiring soon!)

- Any additional documentation requested by the lender

The better organized you are before applying, the faster we can start getting you approved for your new dream RV!

6. Avoid Large Purchases or Credit Charges

Timing is everything when it comes to your credit profile. Before and during the loan approval process, avoid making large purchases or taking on new debt. This could include new credit cards, financing another vehicle, or making a significant withdrawal from your savings account.

Any major financial change can impact your credit score and DTI ratio, which as we discussed, plays into your likelihood of getting approved for your RV loan.

7. Factor in Seasonal Timing

Like many things, there are peak seasons for purchasing an RV. Prices for RVs often dip in late fall and winter, which could allow for more savings and consequently lower your premium. If you have the flexibility to plan your purchase during a buyer-friendly season, you can maximize your savings. If your timing is not flexible, we still will work with you at My Financing USA to get you the best financing options year-round.

8. Research Loan Term Lengths

Not all loan terms are created equal. The length of your loan can impact your monthly payment, total interest paid, and even your eligibility.

Recreational loan terms can range from five to twenty years, depending on the loan amount, the unit’s age, and your credit profile. Researching how these all factor into the term length can allows you to make educated decisions to fit your needs. We highly recommend that you have a general knowledge of what you would like your payment to be and how different loan types can affect that number.

9. Prepare for a Waiting Period

While we like to operate as swiftly as possible to get you on your way, once you have been approved, remember that funding the loan may take a few business days, especially if you are buying from a private seller rather than a dealer. We will need copies of additional documents from them as well.

Building in a little extra time between loan approval and your first planned trip ensures you are not rushing paperwork or risking delays.

10. Consider Getting a Co-Signer if Needed

We understand credit scores can only be controlled so much. If your credit score or income level isn’t as ideal as you’d like it to be, having a co-signer can make a significant difference in your approval odds.

What is a co-signer? A co-signer agrees to share responsibility for the loan, which can strengthen your application and help you secure better rates and terms. While you of course can apply as an individual, we do recommend talking with them ahead of time to ensure they are comfortable with the responsibility.

Ready to Start Your Journey?

Taking the time to prepare before applying for an RV loan can put you in the strongest position possible and make your dreams of adventure a reality sooner.

At My Financing USA, we are here to guide you every step of the way, whether you are buying your first RV, upgrading to a new unit, or exploring financing options with less-than-perfect credit.

Apply today and get ready to embark on your next great adventure!