Quick Navigation:

- The Differences Between a Hard Inquiry and a Soft Inquiry

- How Do Hard Credit Inquiries Affect Your Credit Score?

- How Much Do Credit Inquiries Affect Your Credit Score?

- What Do Credit Loan Companies Look For?

- How You Can Raise Your Credit Score After a Recent History of Hard Inquiries

- How Can You Keep Hard Inquiries to a Minimum?

- How Do You Check for Hard Inquiries on Your Credit History?

- How Do Multiple Credit Inquiries Affect Your Credit Score?

- How Much Does a Soft Inquiry Affect Your Credit Score?

- How Long Do Hard Inquiries Affect Your Credit Score?

As you prepare to apply for a loan or open a new credit card, you might be curious about what impact the credit inquiries required for getting your new account started will have on your credit score. Our guide provides information on what exactly a credit inquiry does to your credit score.

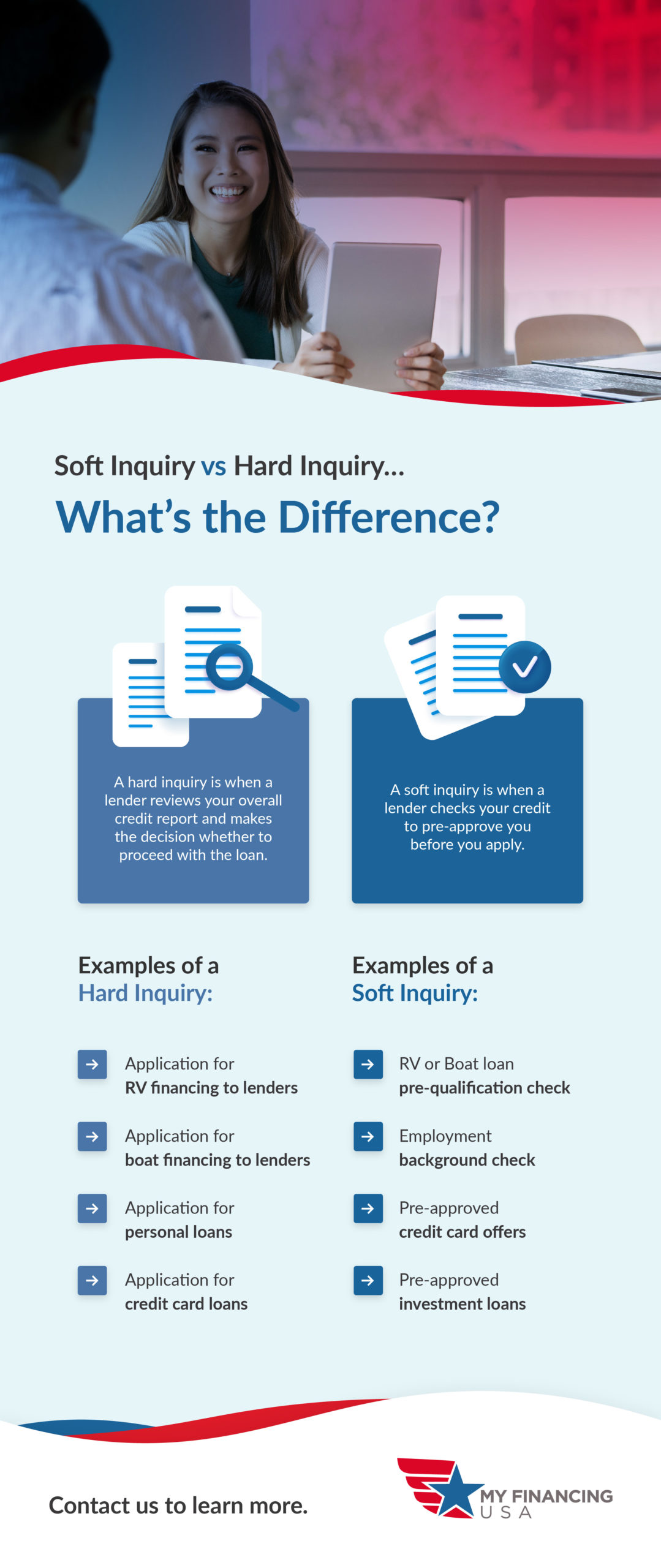

The Differences Between a Hard Inquiry and a Soft Inquiry

A hard inquiry is when a lender reviews your overall credit report and makes the decision whether to proceed with the loan. This type of credit inquiry will influence your overall credit score as it will be recorded on your credit report.

A soft inquiry is when a lender checks your credit to pre-approve you before you apply. This kind of inquiry leaves your credit score unaffected.

Examples of a Soft Inquiry

Examples of a Hard Inquiry

- Application for RV financing to lenders

- Application for boat financing to lenders

- Application for personal loans

- Application for credit card loans

How Do Hard Credit Inquiries Affect Your Credit Score?

Although soft inquiries leave your credit score unchanged, hard inquiries do temporarily lower your credit by a small number of points. This type of inquiry gets reported on your credit so lenders know how often you have applied to open a new account for a car loan, mortgage, credit card, or other reason.

The number of new hard inquiries on your record is a useful way of tracking the likelihood that you will be able to keep paying for all lines of credit. Hard credit inquiries are only one factor that lowers credit, and for those who already have excellent credit scores, they have a small impact.

How Much Do Credit Inquiries Affect Your Credit Score?

A hard inquiry could drop your score by at least five points. It is unlikely that a single hard credit inquiry will lower your score enough to impact your chances of getting approved. A credit inquiry lowers your score by a minuscule amount and is usually only a problem for those with unstable or low credit.

However, if you have signed multiple applications for credit in recent months, your credit score could have been impacted more than you might expect. Making a soft inquiry into your own credit history and reviewing your report can help you know what to expect when applying for a new line of credit.

What Do Credit Loan Companies Look For?

Loan companies and lenders complete credit inquiries before approving or denying loans. If you are looking for financing plans to purchase an RV or a boat, you might want to take a look at the list of guidelines that credit companies look for before they decide to approve a loan for a client.

- Opening several credit accounts: Opening multiple credit accounts in a short period can be concerning to lenders. Lenders may feel you are taking on too much debt or having financial difficulties. This can decrease your chances of approval for new loans.

- Large balances on credit cards: Carrying large outstanding balances on credit cards often makes lenders believe you are not living within your means. Try to keep credit card balances as low as possible, preferably below 30% of the maximum limit.

- Paying your bills on time: How efficiently you pay your bills and installments are important factors that credit companies look for on your credit report. If there is any kind of delays or outstanding debts, it is highly unlikely that lenders would approve new credit loans for you until all unpaid bills are fulfilled.

- Income and expenses: Lenders consider clients with a debt-to-income ratio below 40% to be lower risk than those with a higher debt-to-income ratio. The debt-to-income ratio is the percentage of your debt payments in comparison to your income.

- Down payment: Although most lenders require a down payment ranging from 10%-20% of the purchase price, My Financing USA will work with you to get the lowest down payment possible based on your specific information.

When you are applying for an RV or boat loan, it is always a good idea to review your financials and ensure you can take on the new debt and the costs associated with owning a boat or owning an RV. My Financing USA is willing to help you secure the best financing for your RV or boat loans.

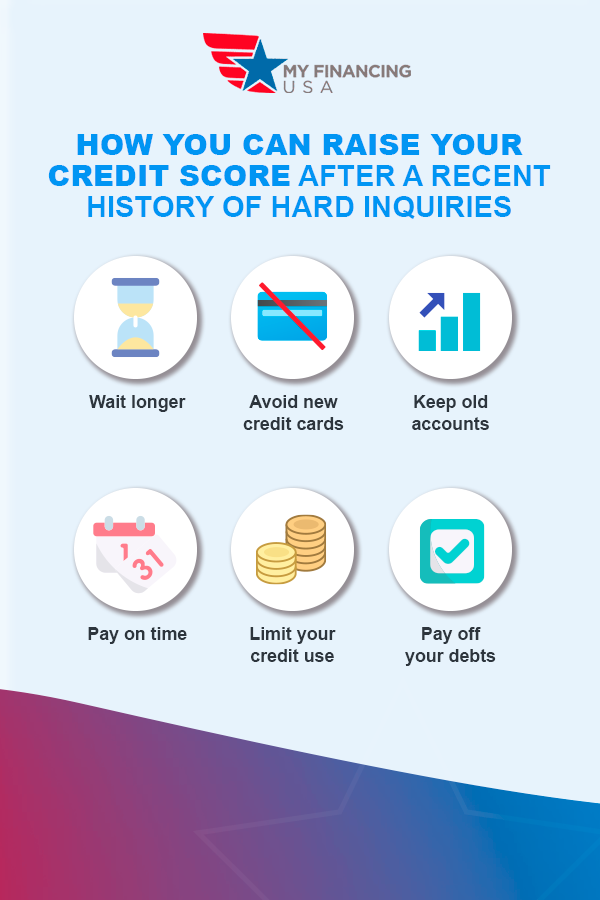

How You Can Raise Your Credit Score After a Recent History of Hard Inquiries

It's common to accumulate credit card accounts for promotions and discount opportunities without realizing that opening all of those new lines can affect your chances of a lender approving you in the future. If you're trying to get approval for a loan, and you're concerned about the number of recent hard inquiries on your record, try the following tips:

- Wait longer: See if you can wait a little longer before applying. Try to wait at least six months before opening another application, and check again to see if some of your earlier hard inquiries have dropped. Your chances will improve the longer you can wait between your last hard inquiry.

- Avoid new credit cards: This includes any card you can get in exchange for discounts at retail stores or pre-approved cards you receive through the mail. Opening a new credit card can be a great way to build up your score over a long-term period, but even a hard inquiry left by a store card will slightly affect your score. If you hope to get approved soon for an important loan, more hard inquiries could result in fewer quality offers.

- Keep old accounts: Avoid closing your credit card accounts. If you have already gone through the process of opening new accounts, closing them generally lowers your credit score. Lenders consider closing a line of credit to be a red flag. This is especially the case when you terminate a credit card that you have had for a long time and has been in good standing in recent years.

- Pay on time: Make payments on your credit lines on time. If you miss a due date, pay off the missed payment within 30 days to ensure the mistake goes unreported to the credit bureaus.

- Limit your credit use: Keep your credit utilization under 30% by spending less or using your credit cards less frequently. You can also lower your credit use by spreading the amount of money you spend between each of your cards.

- Pay off your debts: If you have had recent debts sent to collections, pay off the totals you owe. If you never submit payments for your debt, it would take about seven years before an idle collections entry gets dropped from your credit report.

How Can You Keep Hard Inquiries to a Minimum?

When you're considering making a significant investment, your credit is a priority. To limit hard inquiries from lowering your credit score, try these strategies:

- Do your own soft inquiry: Investigate your own credit with a soft pull before you go looking for lenders. This way, you can get an idea of what to expect from your offers, and you have a better chance of knowing when your credit is out of a certain lender's range.

- See if your lender can make a soft inquiry instead: Ask your lender if they can use a soft pull to check if you qualify instead. Certain applications might require a hard inquiry, but you can speak with a representative to find out if a soft pull is an option. If your credit score is over a certain number, this might be feasible, but it also depends upon what kind of credit line you're applying for.

- Shop for the best rates: Go through a company that helps you shop for the best available rates. If you're planning to get a loan for an RV or boat, for example, My Financing USA runs a soft pull initially to ensure that you qualify with certain lenders. Next, the potential lenders run hard inquiries into your credit with your permission. This process results in fewer overall hard inquiries on your record, with lenders specially selected for your compatibility.

How Do You Check for Hard Inquiries on Your Credit History?

The easiest way to keep track of how many hard inquiries you have had is to order a report from one of the major credit reporting bureaus. Using a soft pull to check into your own credit, you can look for hard inquiries in your report. You might see more entries than you expected, but this is common when you go rate-shopping.

When multiple lenders made a hard inquiry into your credit for the same type of loan, all of the hard inquiries are listed in the report, but they typically get configured into your credit score as a single hard inquiry. This is because the credit reporting bureau understands that you were looking for a specific line of credit from the lender who offers the best rate rather than trying to open multiple accounts.

How Do Multiple Credit Inquiries Affect Your Credit Score?

Having several inquiries can reduce your overall credit score and affect your potential for RV or boat loan approval. Lenders use your credit report to conduct a risk assessment. Seeing many recent inquiries on your record — for a series of recently opened credit cards, for example — can affect their decision to offer a loan to you.

Too many hard inquiries can be concerning to lenders, but several inquiries might be considered a single inquiry if they were made by competing lenders between 14 to 45 days. Multiple hard inquiries may add up to numerous new lines of credit, which makes you a higher-risk borrower. This may make the lenders feel you are taking on too much debt or having financial difficulties. A hard credit inquiry would typically remain on your report for 24 months and can cause temporary fluctuations in your credit score.

How Much Does a Soft Inquiry Affect Your Credit Score?

After reviewing your credit and spotting soft inquiries on your record, you might have wondered if a soft inquiry affects your credit score at all. A soft inquiry is only visible to you on your own credit report. Soft inquiries are unlisted for any third party running a credit check on you, which is why your credit score remains unchanged after a soft inquiry. If you're concerned that a series of soft inquiries seemed to have lowered your credit score, check for hard inquiries on your report, which might have been the culprit.

How Long Do Hard Inquiries Affect Your Credit Score?

After discovering that hard inquiries impact your credit score, you probably want to know how long it will take before your credit goes back up. After about two years, a hard inquiry vanishes from your report, and your score will compile without it. You can wait significantly less time to contact another lender about opening a new account, however.

If lenders have made a recent hard inquiry into your credit, try waiting at least six months before you contact another lender or apply for an important credit application. Ideally, one year is enough time between the inquiries to give you the best possible chance of securing your new line of credit.

How My Financing USA Helps You Find Lenders

A dealer might send out inquiries to multiple different lenders on your behalf. If you decide that none of those options are good for you, you will have to begin the process again with another dealer. The resulting number of hard pulls could lower your credit score, which means that you could get offered higher interest rates instead of the low rates you might be offered if you apply through My Financing USA.

With our hands on approach and pre-qualification process, we reduce the number of inquires from lenders by only sending you to lenders that match your needs.

Get an RV or Boat Loan With My Financing USA

At My Financing USA, we offer fast and easy approval and use a process that reduces credit inquiries to keep your credit score intact. Learn about our streamlined process for connecting you with a quality lender for an RV loan or a boat loan before making your final decision. If you know what you're looking for, go ahead and apply for an RV or boat loan with us online today.