Quick Navigation:

- Credit Score

- Opportunity Costs

- Emergencies and Unexpected Expenses

- Tax Benefits

- Paying off Higher-Interest Debt First

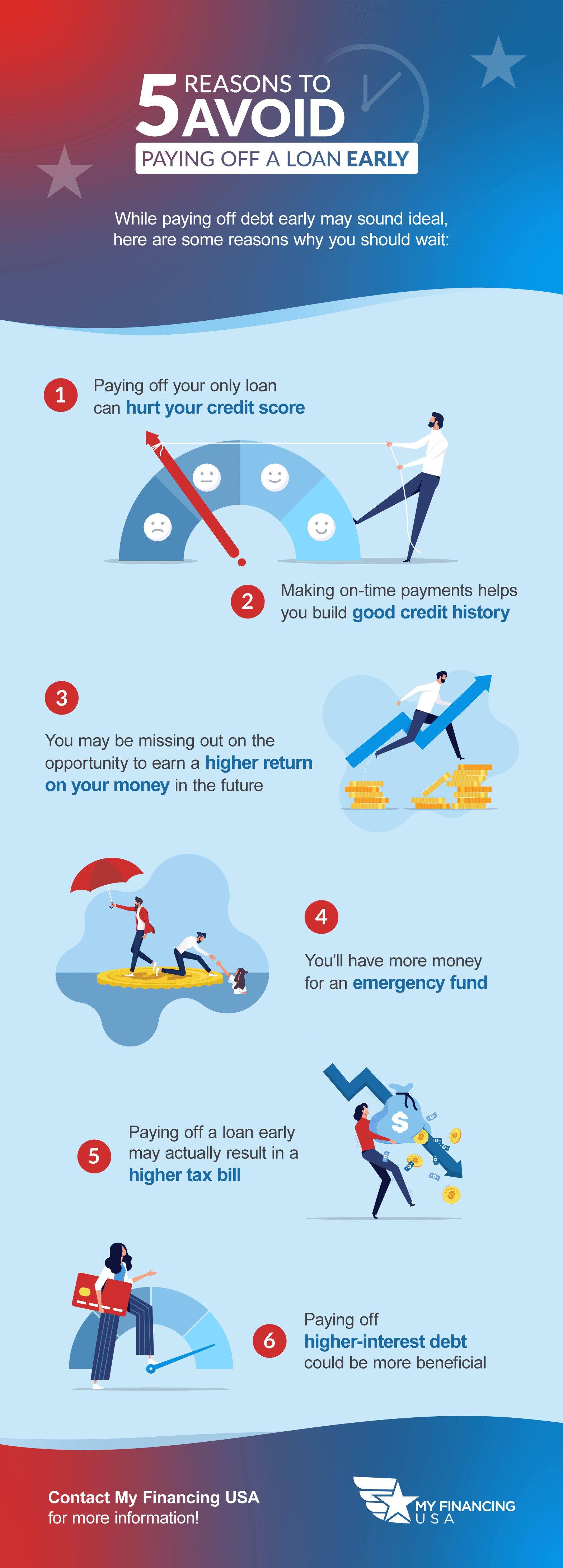

When it comes to managing personal finances, one of the biggest questions many people face is whether they should pay off their loans early or stick to the regular repayment schedule. While the idea of getting rid of debt as soon as possible may seem appealing, there are certain situations where paying off a loan early may not be the best option. In this article, we will explore some of the reasons why someone should not pay off a loan early and why they should consider paying off higher-interest debt first.

Credit Score

Paying off a loan early could actually hurt your credit score. Your credit score is a reflection of how well you manage your debt, and paying off a loan too quickly could indicate to lenders that you are not capable of managing debt effectively.

Additionally, depending on your mix of account types, paying off a loan can negatively impact your credit scores. In some cases, paying off a loan will actually lead to a credit score drop, despite the positive effect of debt repayment on the rest of your financial life. As Experian explains, "If the account you paid off was your only installment account, your credit score could be negatively impacted by paying off the loan because you would no longer have an active installment account."

It's important to keep in mind that credit scoring models take into account a variety of factors beyond just debt repayment, including consistently making on-time payments. According to TransUnion, "Payment history is the most important factor in your credit scores, so making on-time payments on your accounts is critical to maintaining a good credit history." In other words, paying your bills on time is the most effective way to build a positive credit history, and paying off a loan early may not always be the best way to achieve that goal.

Opportunity Costs

Another reason why someone should be cautious about paying off a loan early is the concept of opportunity costs. Opportunity cost refers to the potential benefit that could be gained from using the money you would have used to pay off your loan early for other purposes, such as investing in a business or buying a property. By paying off your loan early, you may be missing out on the opportunity to earn a higher return on your money in the future.

Emergencies and Unexpected Expenses

Life is unpredictable, and emergencies can happen at any time. If you pay off your loan early, you may not have enough cash reserves to deal with unexpected expenses, such as a medical emergency, job loss, or major car repairs. By keeping your loan balance and making regular payments, you can ensure that you have a safety net to fall back on in case of an emergency.

Tax Benefits

In some cases, paying off a loan early may actually result in a higher tax bill. For example, if you have a mortgage on your home, the interest you pay on that mortgage is tax-deductible. By paying off your mortgage early, you may be losing out on this tax deduction, which could result in a higher tax bill at the end of the year.

Paying off Higher-Interest Debt First

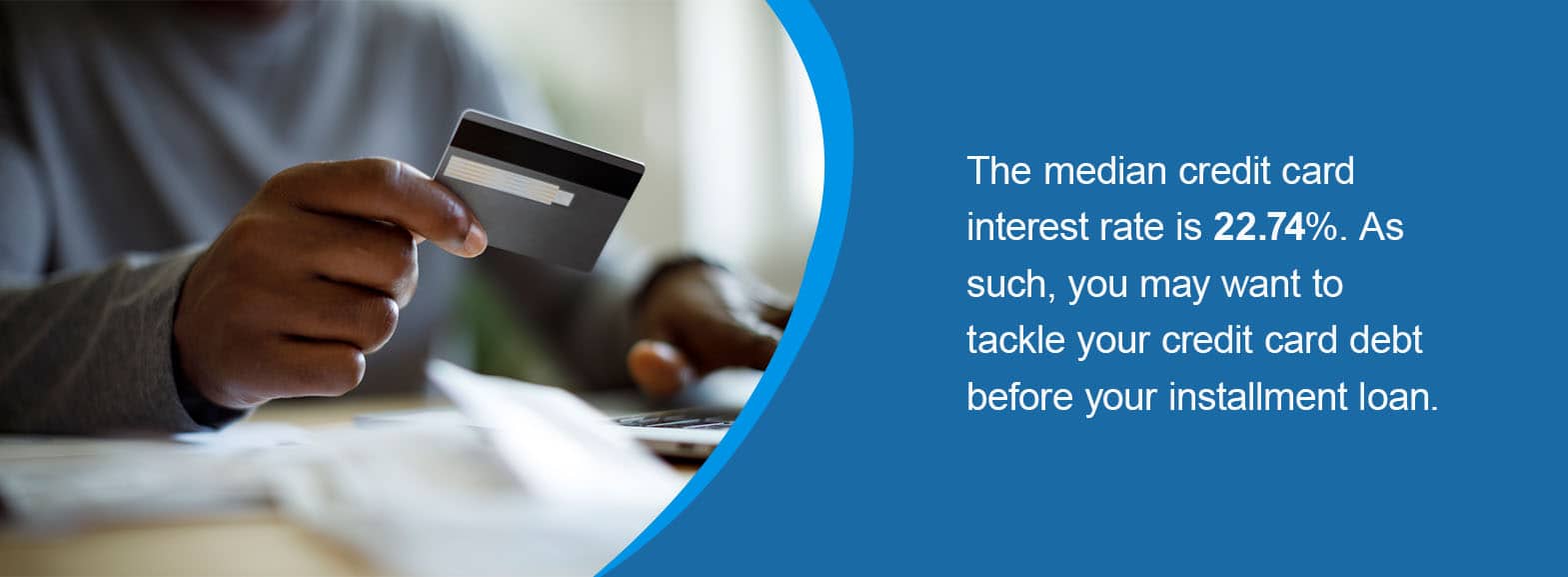

If you have multiple debts, it may be more financially beneficial to pay off the debt with the highest interest rate first. This will allow you to save money on interest charges over time and reduce the overall amount of interest you will pay on your debts. By focusing on paying off the highest-interest debt first, you can free up more money to put towards other debts and ultimately become debt-free faster.

While the idea of paying off a loan early may seem attractive, it is not always the best option. The impact on your credit score, missed investment opportunities, unexpected expenses, potential tax benefits, and paying off higher-interest debt are all factors that should be considered before making a decision.