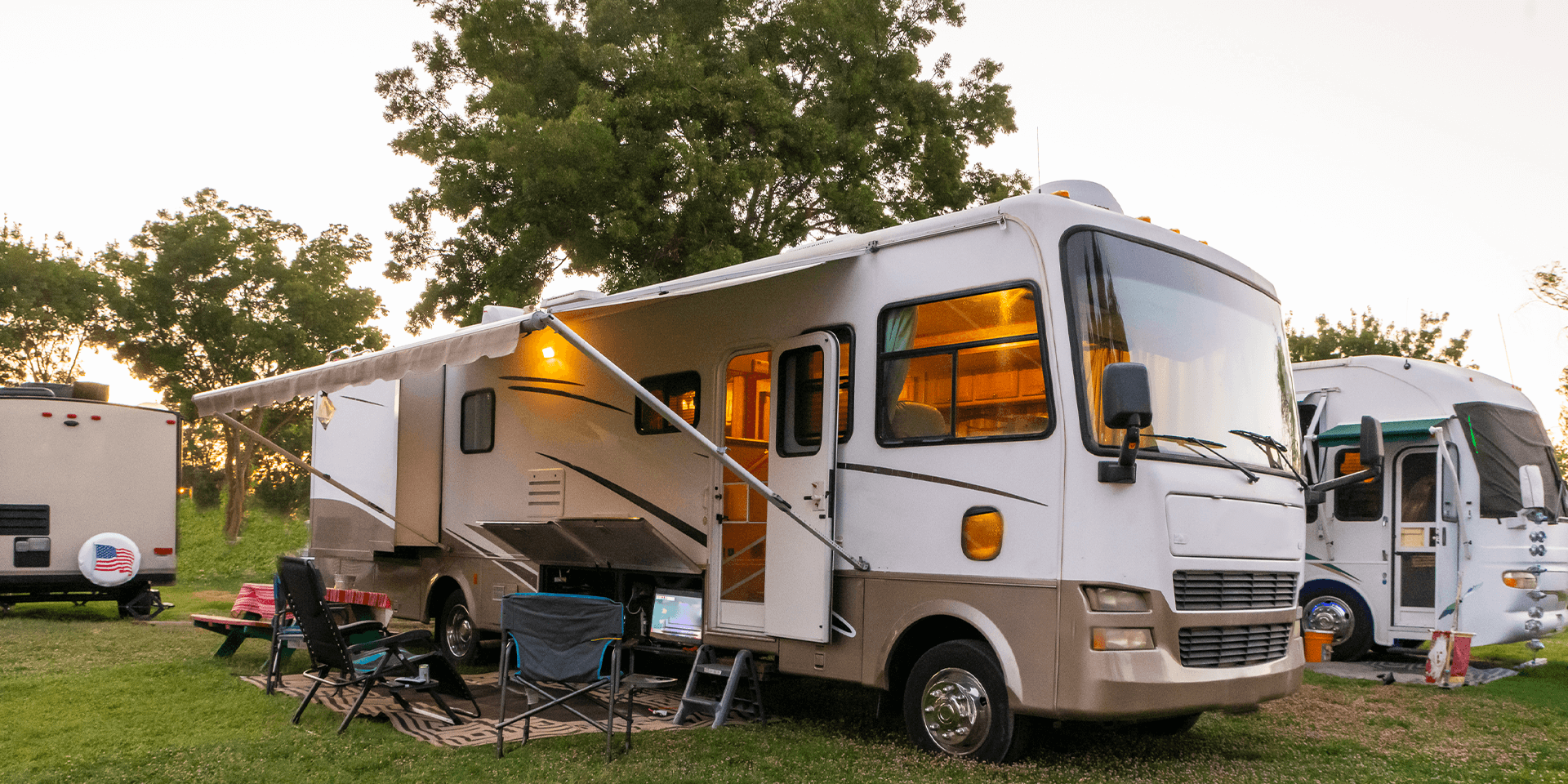

10 Things to Do before Applying for an RV Loan

Quick Navigation We understand how exciting buying an RV can be, but taking the right steps before applying for an RV loan can make a significant difference in not only your experience, but also securing the best financing available. To help you get started on the right path, we have outlined ten essentials before submitting ...